ONESOURCE Statutory Reporting

The future of statutory reporting

Harness the power of cloud technology for statutory reporting, everywhere you operate

Learn more about ONESOURCE Statutory Reporting

Compliance

- Content-enabled: ONESOURCE Statutory Reporting offers a powerful blend of automation and extensive content, providing you assurance on adherence to local compliance regulations.

- Global coverage: Purpose-built tool, with coverage throughout Australia & New Zealand, Asia, Europe, the Americas and South Africa. Embedded, best-practice content for over 45 countries.

- Local compliance: Compliant with local GAAP and in the local reporting language, which can be translated into English, simplifying your upstream and downstream report preparation and review process. Pre-tagged with the appropriate XBRL taxonomy.

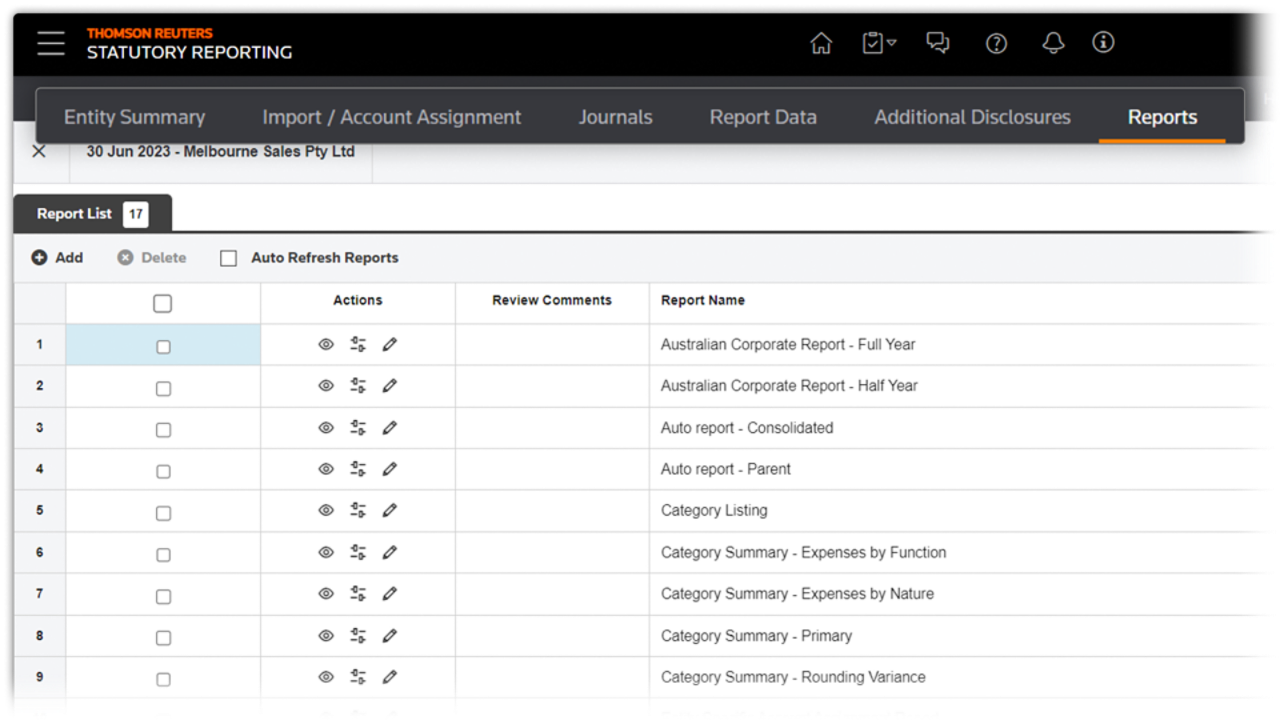

- Comprehensive automation: Increase efficiency and accuracy when preparing your reports with automatic rounding, note and page numbering, referencing, pre-tagged XBRL reports and roll-forward process.

- Content updates: Includes country-specific content updates from Big Four firms and in-house content experts. Insert and customise new disclosures in your reports using our standard templates or create and control your own specific disclosures.

Connectivity

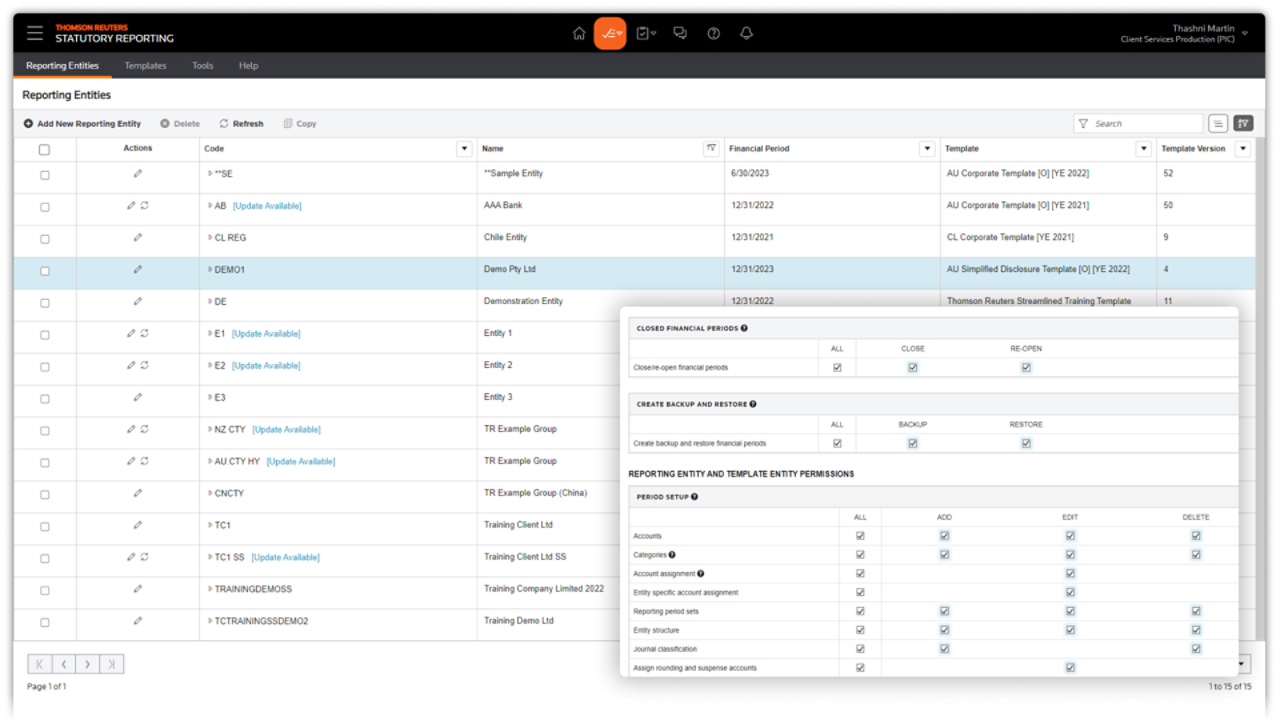

- Cloud technology: Access ONESOURCE Statutory Reporting anywhere, anytime. This cloud-based solution enhances flexibility, enables global collaboration, and provides instant content updates for your organisation.

- Improved transparency: Streamline account sign-offs, reduce iterations and touchpoints. A comprehensive audit trail from trial balance to reports enhances transparency of reported figures.

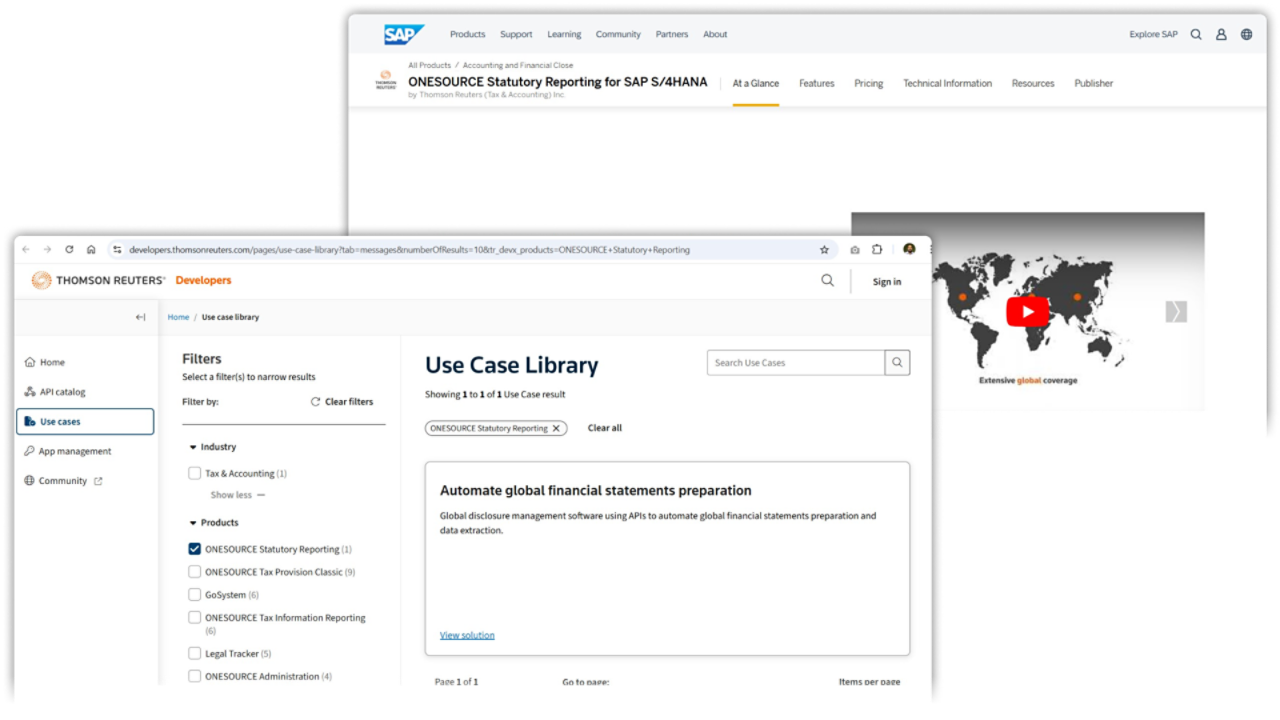

- API-enabled: Integrate third-party systems/ ERPs with ONESOURCE Statutory Reporting using APIs to streamline data flow. Utilise connector with SAP S/4 HANA for enhanced connectivity and efficiency.

- Platform advantage: Utilise connectivity with ONESOURCE Workpapers and more, for end-to-end automation, accuracy, and better coordination.

Talk to an expert

Take the initial step towards efficient and compliant statutory reporting.

Change

- Enhanced collaboration: Integrated workflow solution enhances task management, enables email notifications, and offers a dashboard view streamlining your reporting process. Multi-user editing and review functionalities enhance collaboration

- Efficient process: ONESOURCE Statutory Reporting streamlines financial statement preparation, reducing time spent on data gathering and report revisions. This accelerates access to crucial information and expedites the overall financial process.

- Stay ahead of the curve: Centralise data capture and formatting while maintaining content integrity across entities. This creates a single source of truth, ensuring organisational consistency. Spend less time managing data and fixing errors.

- Transform: ONESOURCE offers a unified platform for streamlined financial reporting. Its global templates and translation tools optimise operations, benefiting your entire business. Attract and retain the top talent with industry-leading technology.

Frequently asked questions

ONESOURCE Statutory Reporting is a leading cloud-based software for global -disclosure management — helping companies to remain compliant in over 45+ countries. It empowers organisations to streamline the preparation of their statutory financial statements and notes/ disclosures by automating processes and providing best-practice, country-specific content throughout Australia, New Zealand, Europe, Asia, - the Americas and South Africa.

When choosing a statutory reporting solution, it's important to look for features like compliance with accounting standards, strong internal control capabilities, and customizable reporting options to meet diverse auditor preferences. Customers often raise objections about compatibility with existing systems and the potential for increased audit scrutiny. To address these concerns, ensure the solution offers seamless integration, robust documentation features, and training support.

ONESOURCE Statutory Reporting is ideal for companies that need to adhere to XBRL standards. The provided standard content is pre-tagged, and the software can export your report in the correct XBRL format, ensuring it meets the specific tagging requirements for electronic filing with regulatory bodies. This eliminates the necessity for manual tagging or outsourcing of the process.

ONESOURCE Statutory Reporting leverages APIs to facilitate seamless integration with existing in-house software, enabling smooth data flow between them. Furthermore, it offers a direct connector with SAP for enhanced connectivity and efficiency.

Experience it for yourself

Discover how our world leading platform ensures your legal spend remains optimised and adaptable to future changes.

Have questions? Contact a representative